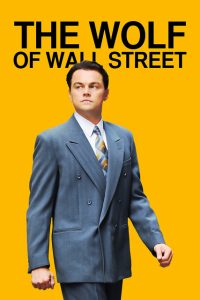

Raise your hand if you’ve seen the movie The Wolf on Wall Street. Now, raise your hand if you thought it sucked.

Really, I’m the only one?!

The Wolf on Wall Street is based on the real life accounts of Jordan Belfort. Belfort was a con-artist stock broker who made millions of dollars by selling penny stocks to his clients. He promised riches to unsuspecting people while putting nearly half of their money into his own pocket.

Honestly I was a bit appalled by this movie (it was more like porn in my opinion.) Nevertheless, there were a couple valuable pieces of information we can take away from The Wolf on Wall Street.

Here they are.

You DON’T Need a Financial Advisor

Belfort and his crew cold called their way into millions of dollars. They promised big returns to their clients but were selling crap stocks. All they cared out about was making money for themselves

In this movie these stockbrokers are probably the worst case scenario types. But do you really want to pay someone to lose money for you?! You are the most qualified person to do your own investing. Nobody can predict what the stock market will do – not even a certified financial advisor.

Your best bet is to do plenty of research and pick investments that you feel comfortable with.

Be Wary of Penny Stocks

I learned this lesson prior to watching The Wolf on Wall Street, but the movie was a great reminder.

When you’re a beginner investor, penny stocks are not the way to go. Sure, you may be able to pick a lucky winner every now and then but buying penny stocks is pretty much just gambling.

You’re far better off buying stocks in companies that have an established track record when you’re just starting out. Actually you don’t have to buy individual stocks at all. You can try your hand at mutual funds or index funds.

Go With What You Know

As illustrated in the previous two points you are the best person to pick your investments. When you’re investing you need to understand what you’re investing in.

You need to know about the company, how they make money, and how much debt they are in among other criteria. You’re far more likely to find investing success when you think long term.

Conclusion

You don’t need a financial advisor to begin investing. Read a couple of investing books and slowly get started. You’ll find that investing is actually pretty simple.

And in case you were wondering what happened to Belfort the IRS came after him for $110 million two weeks after the movie aired! Craziness!

Did you enjoy The Wolf on Wall Street? Any financial takeaways?

Great stuff as usual.

Belfort got so many complaints that eventually the government had to shut down his business. That hard to do, getting attention from the SEC is hard.

I’ve seen a couple of belfort’s “training seminars”. He’s kind of a sleazy dude.

-James