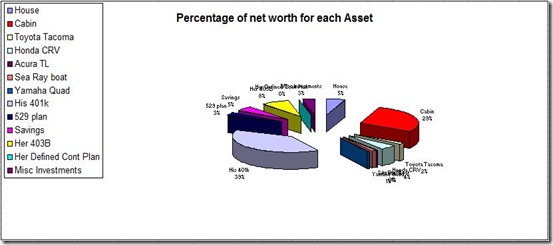

I was looking at one of the spreadsheets I use to track our budget and net worth and thought maybe people might be interested to see how our net worth breaks down. While I’m not showing our exact net worth (we did just hit a major milestone), this gives you an idea of the assets we have that make up our net worth. It won’t take long to notice that surprisingly our house makes up a very small amount of our net worth. We have kept a mortgage on the house but we own everything else on the chart. We do own our second home which gives us some peace of mind that we always have somewhere to live, no matter what happens with our finances. Luckily we do have some equity in our main home so if we ever had to sell (even in this market) we’d still be able to take a bit of cash with us.

As you can see from the chart, we definitely have a few toys. I’ve really struggled over the years to find balance between saving for tomorrow and living for today. Believe it or not, I think we’ve managed to come up with a pretty balanced approach (I used to error on the side of saving everything and not enjoying the present day as much). Each of the “toys” you see listed below were only purchased after ALL of our savings goals were met and only when we had the cash to buy them. Yes, we have three cars and two drivers. It’s excessive but I grew up in the automotive industry and have a deep affection for cars. The Toyota is an older model pickup and is worth more to me than I could sell it for. Anyway, I just thought you might like to get a sense of how our assets are split up. You can also see that we aren’t doing that well with our non-IRA investments. That’s something I’m working on this year. The reality is that we need to put more in to non-retirement investment accounts.

*note: As I mentioned above, we own all of these assets out right except for the house. The house 5% value represents the equity we have in the house after subtracting the mortgage.