When it comes to the debate of whether renting or buying a home is the better choice for you financially, there are a lot of factors you need to consider.

For most people buying a home is often the way to go when it comes to saving money, but depending on your lifestyle that choice might not be right for you.

The majority of people begin their journey into adulthood by renting. With the economy being in the state that it is most young people simply can’t afford the upfront costs of buying a home right away.

However, once they become settled in their career, they may find that buying a home makes more sense financially. To give you a better idea of what choice is right for you when it comes to buying vs renting, we’re going to go over some of the most important factors.

Buying a Home vs Renting | Factors to Consider

While we would like to go ahead and say that buying will ultimately save you money in the long run, the cost of owning vs renting varies depending on the state where you live. In some areas, you may only notice a small difference in price, whereas in other locations the cost of renting is more than double what you would pay for a mortgage.

However, location is only one thing you need to think about when it comes to the cost of living. If you want to save money, you need to consider the long-term effects of your choice.

There are a lot of upfront costs when it comes to buying a home, but if you plan to reside there for more than 7 years those initial upfront costs could save you money with time.

How Interest Rates Should Affect Your Decision

When you apply for a mortgage, you will be given an interest rate based on your overall credit score. This interest rate is one of the main kickers that determines whether or not buying is more affordable than renting based on your current lifestyle.

If you have a good credit score, then you are likely to get a lower interest rate, which will make buying a home a more affordable choice in the long run.

If your credit score isn’t the greatest but you still get approved for a mortgage then you will probably get one with a higher interest rate. With a high interest rate, your mortgage might end up being more expensive than renting. In this situation, it’s a good idea to rent until you can get your credit score in a better place.

That Tax Deduction Though!

One of the perks of owning your home vs renting is that you qualify for a tax deduction on your mortgage. That tax break is something you can’t benefit from if you stick to renting.

Do The Upfront Costs Pay For Themselves?

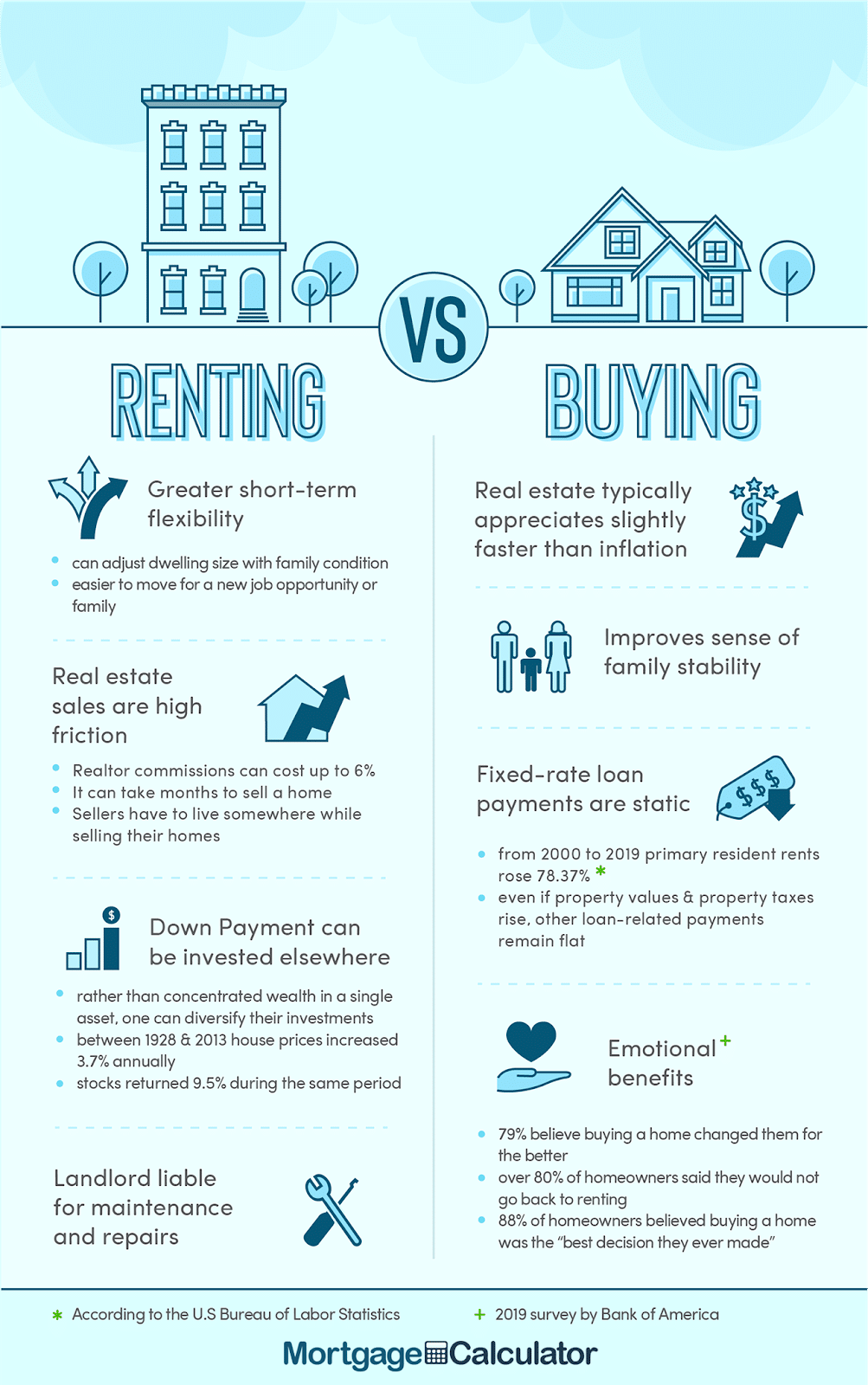

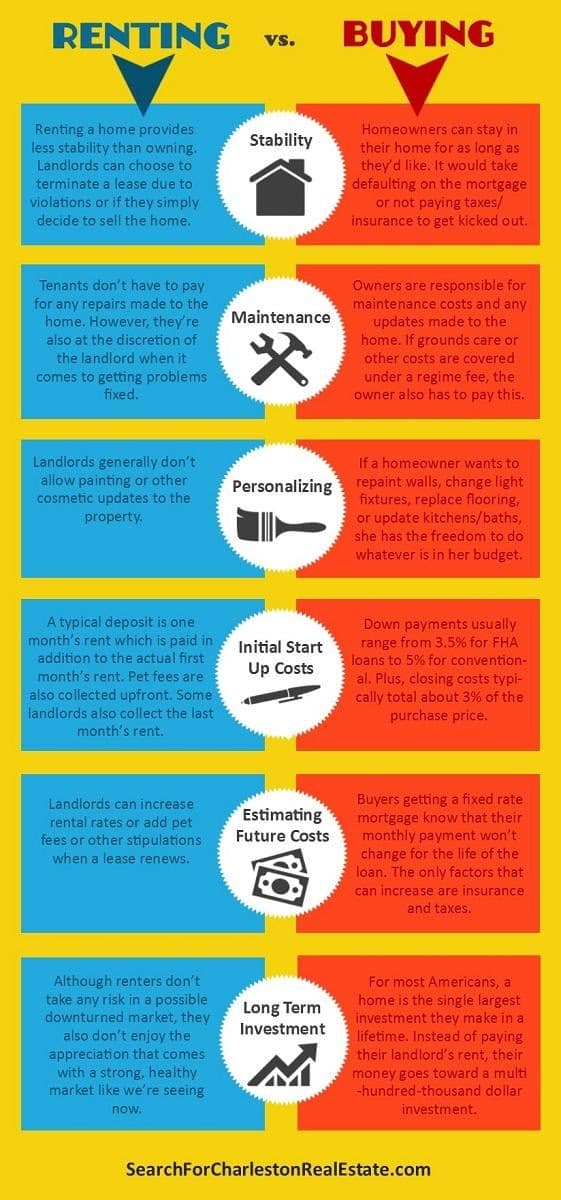

When you purchase a home, there are a lot of upfront costs—like the downpayment, closing costs, all of the inspections—that you don’t have to deal with when you rent.

In most cases, a renter is only responsible for a security deposit and the first month’s rent before the expected move-in date—possibly a pet deposit, if your landlord allows it.

On the other hand, a homeowner needs to have earnest money to show that they are serious about investing in the home.

After that, they need to provide anywhere from 3.5% to 20% of the cost of the mortgage for the agreed-upon down payment. Then, as alluded to above, they need to pay for a home appraisal, property taxes, home insurance, home inspection, and possibly even closing costs.

That seems like a lot of money upfront, but studies have shown that homeowners who reside in their homes for more than 7 years will benefit from those upfront costs and end up saving money over time.

Other Factors to Consider

When it comes to renting, if you aren’t living in a rent-controlled area, then your landlord can legally increase your rent every time you sign a new lease. This leaves many renters feeling anxious that their apartment or dwelling may become too expensive over time.

Repairs are another thing you need to consider. Are you in a place financially where you can afford to repair a leaky roof or repair a door that won’t stay closed? Homeowners are responsible for paying for the cost of all their renovations and repairs.

When you rent you don’t have to worry about how much it costs to fix these things, your only responsibility is to tell the landlord.

However, some people have had issues with landlords not maintaining the property as per the lease states. When you own the home you have the freedom to make sure everything is maintained to your expectations.

Do You Really Save Money Buying a Home vs Renting? Final Thoughts

Whether or not you will save money by owning a home all depends on your living situation. Here is a good way to break it down:

- If you have good credit and plan on staying where you reside long-term, then there is a good chance that owning a home will be a better choice when it comes to saving money.

- However, if your credit isn’t good then you are probably better off renting right now.