What is an EIN?

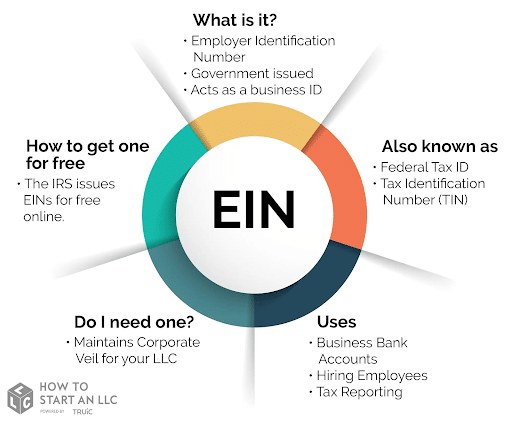

An EIN, short for Employer Identification Number, is to a business what a Social Security Number (SSN) is to a person. It is a great way to uniquely identify your business, and is useful for so many things. The EIN allows the IRS (Internal Revenue System) to identify taxpayers, and keep track of a business’ tax reporting. It is also sometimes known as a FEIN (Federal Employer Identification Number) or a FTIN (Federal Tax Identification Number).

Do I need to get an EIN?

The IRS has reasons on their website clearly labelling why you should get an EIN, should need ever arise or whether you’re legally required to, given what type of business you conduct and how you conduct it. Some necessary reasons why you need an EIN include the fact that you have employees, you are a partnership or a corporation, or you own a trust or an estate.

There are other reasons why you’d also want to get an EIN, such as being able to open a business bank account, being able to use self-employment retirement plans and things like filing for bankruptcy.

All in all, even if you don’t need an EIN straight away it’s a great idea to get one.

How do I get an EIN?

There are many possible options for getting an EIN, and fortunately they’re more or less free, depending on how you do it.

The quickest and easiest way to get an EIN is to apply on the IRS website using the EIN assistant. You can also speak to an IRS representative at 800-829-4933, and answer a few questions about your business. The IRS’ hours of operation are from 7am to 10pm and you’re allowed to apply once per day, should you make a mistake. Your application needs to be finished in one session, and it cannot be saved. If you’re not done by 15 minutes, which is more than enough time if you have all the documents on hand – be prepared – and you’ll get an EIN straight after the session is completed.

You can also get a tax ID number by faxing or mailing the IRS Form SS-4. This is a slower process – if applied for by mail it can tax up to 4 weeks to receive, while faxing allows it to be issued in only 4 business days. If you are submitting by fax, send your EIN application to fax number (855) 641-6935. If applying by mail, submit to Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999.

You’ll need to give some basic information when applying for an EIN. Some of these questions are very simple to answer, such as what type of business you have, how many owners it has and what state it’s in. Then there are also questions such as why you want to apply for an EIN and who will be the principal officer of the business. You’ll also need to have an SSN or a TIN for your business.

What if I forget or lose my EIN?

If for some reason you did not note your EIN down, or decided to have it committed to memory but forgot, there are still some options to receive an EIN. You can try looking it up in any emails from the IRS, as well as mail they’ve sent you confirming your number. You can also check any documents that might’ve needed teh EIN, such as tax returns, that should have it on them. But if you still can’t find it all you need to do is dial the IRS EIN department and they shall be able to give it to you.

TRUiC has a huge array of questions and answers on their website about getting a free EIN. Visit their site for more.