Wondering how to live off dividends? You’re not the only one. Having a dividend supported life is a retirement dream but few are able to achieve it. So, today, let’s talk about how you can plan a life living off your dividends!

Is It Possible To Live Off Dividends?

Living off dividends is the ultimate dream. You’re getting regular money coming in, you’re set for life and you can live out exactly how you want to. But there are so few people who actually achieve living off dividends, so it makes you wonder if it’s really possible.

But yes, it is possible to live off dividends. However, you need to be smart about planning your retirement future or your future dividend life won’t be as amazing as you dreamed it would be. So, if you’re planning on doing this, here are a few things you’ll want to do:

Figure Out How Much You Need

Many people don’t really plan for retirement. They think they do, but they set up a plan and never revisit it again. But if you want to truly live off dividends in your retirement years, you need to figure out exactly how much you need so you don’t run into financial issues. A good approach is to look at your average annual salary – and assume you’ll need 75% or more of that. Then assume a 4% withdrawal rate and back into the total figure you need.

Here is a handy calculator to help you back into the total:

Start As Soon As You Can

The sooner you start to build up your retirement portfolio, the better chance that you’ll actually be able to live off dividends. When you’re young, it’s easy to push off retirement, but the earlier you start the easier it is to truly make that happen.

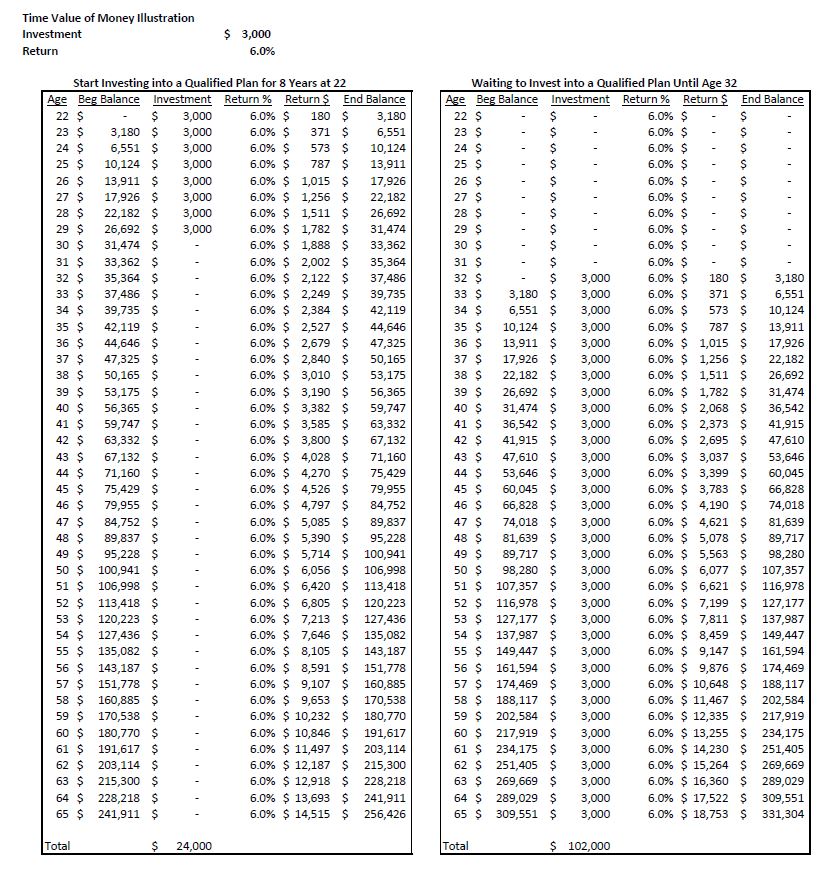

The major reason here is: the time value of money. This is because money invested today gives you much greater value than money invested tomorrow. This is because money invested generally gives you a specific return, usually in the form of dividends or interest. The effects of the time value of money become quite pronounced when you project out the differences over time.

For example, have a look at this comparative chart of two investors. One puts money in at the age of 22, and invests for 7 years. The other starts investing at the age of 32, and invests for 33 years. Both have comparable amounts at retirement.

If audio is more your speed, the Khan academy has a good explanation of this concept.

Don’t Dip Into Your Principle

When it comes to living off your dividends, you should NEVER touch your principle. That means the money that you put in to invest should almost never come out. If it does, you’re not truly living off your dividends and you’re more likely to run out. Of course if you have a crisis – like you get a DUI and you’re going to spend 30 years in jail – then spend the money.

Your principle should always be invested and making you money, and all of the money you need to live your day-to-day life should come right from your dividends. You should only be using the money that you make to actually live off.

Use Examples To Think Carefully About Your Portfolio Composition

The term “live off dividends” implies you’d be living only from your portfolio of dividend yielding stocks. This likely isn’t a good approach as concentrating your wealth in a single asset class concentrates your risk. Instead, a better approach might be to find real world examples of people who have managed to live from the income their investments have generated.

This approach should answer several key questions for you. These are:

- How does one accumulate enough wealth to acquire the income producing assets

- What kind of assets should you purchase? Is stocks alone a good idea? Or should you also add CDs or bonds (yes).

- How do you need to structure the payments? Do you need assets that will pay you every month? Every day? or is quarterly?

Reinvest Continuously

When it comes to creating a robust portfolio that will sustain you through your retirement, you need to continuously invest. The money you make from your investments should be put back into dividends to make more.

The earlier you start, the more you’ll (theoretically) make. Keep reinvesting to make bulk up that retirement fund so that you can truly live off your dividends.

Do you live off dividends? Share your best tip below!

Looking for More Personal Insights?

- Side Hustle Vs Second Job: What’s The Difference?

- Try One Of These Multiple Income Stream Ideas This Year

- Relocating? Moving Costs To Think About

- Here Is An Example of A Nice Little $10,000 Dividend Portfolio

Tae started out as a journalist before following the money into the corporate world. But it turns out that the grass isn’t always greener and now you can find her spending most of her time writing about all the things she loves. Namely, money, travel and business with a hefty dose of self-deprecating humor. She is a podcast fanatic, blogging aficionado and loves to find new ways to turn passions into cold hard cash!