They say necessity is the mother of invention and rightly so. Fintech (a portmanteau for financial technology) has now come a long way. It has brought new investment vehicles, budgeting platforms, wealth management tools that have essentially democratized financial services and products. With micro-investing at the helm, everyone can now own stocks or even get investment accounts from small to big amounts without being a finance expert.

Only a decade ago, investors strapped for capital, were often hard-pushed to invest due to the lack of choices in the sector. Saving accounts were their last resort in most cases. To have an account in a brokerage account, thousands of dollars were required, which limited the customers to high profile entities and individuals.

In the modern era, prospective investors need to come up with $1,000 to purchase a single share of either Amazon or Alphabet Inc. (parent company of Google). This is why micro-investing platforms come in handy and have been nothing short of a godsend for an everyday saver.

How to go About Micro-Investing?

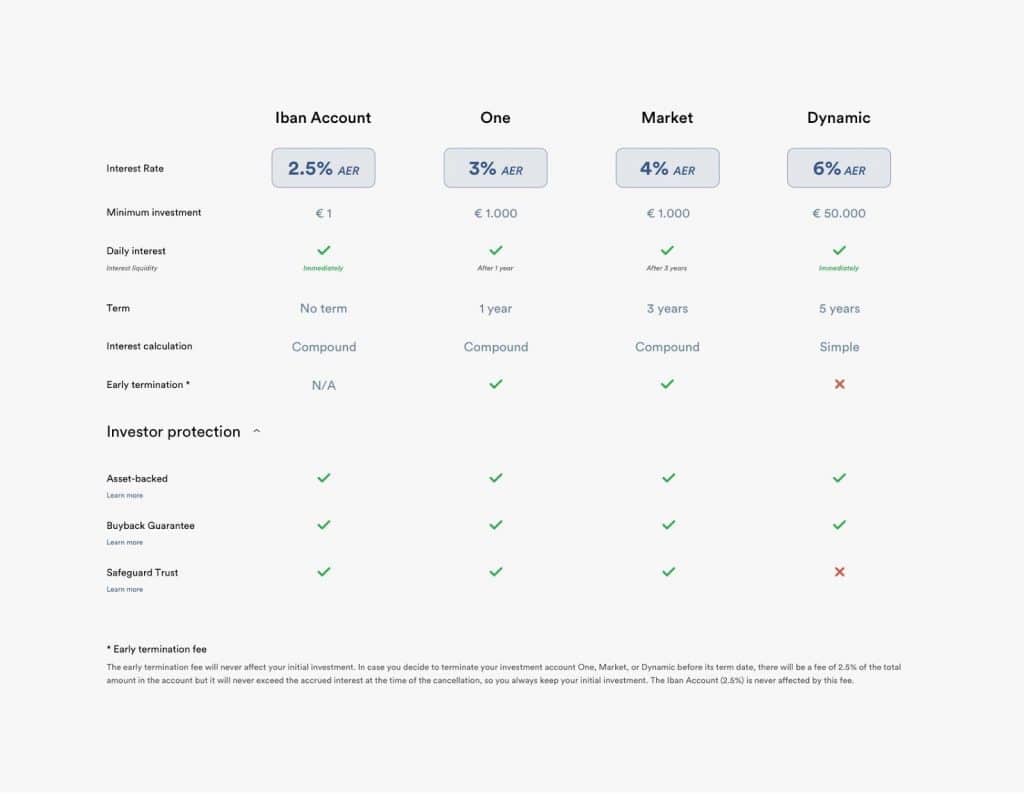

Easy to install investment apps like Iban Wallet make saving and investing much easier than it was before.

Some investment apps factor the risks of the individual such as life plans, age and other variables necessary to determine safe investments and suitable returns for them. Apps like Acorns invests the spare change from shopping purchases while Iban Wallet allows the users to invest with just $1.

With that said, micro-investing acts as a gateway for people with average incomes and small savings to invest and benefit greatly from it. Also, for those lacking experience in the investment arena, micro-investing is a boot camp of sorts for them to learn the ropes.

Who are the potential Micro-investors?

Well, they are millennials. The millennials are strongly backing this booming micro-investing sector. Being risk-averse and tech-savvy, the millennials aspire to automate and optimize their financial standing. Suffice to say, they are the biggest consumer audience of robo-advisors and trading apps.

It does not seem to be a far-fetched assumption to say millennials will outpace the baby boomers as the biggest American generational group in 2019. Therefore, the millennials’ investment choices will also be taken in regard just the same. They have shown an inclination towards growth stocks, tech stocks and are interested in emerging industries, especially those where they can find investment alternative accounts.

The micro-investing sector is most likely to retain its growth and continue to evolve since millennials will enter their prime earning years. Interesting enough, micro-investing isn’t specifically limited to millennials only. It is also a suitable option for retirees and people with low-incomes.

Fees and other Costs

Some of these digital investment portals have no-fee models/no-fee for bank transfers, others do have hidden charges and additional fees. The biggest benefit of these digital platforms is their business model, which requires low-maintenance, and this is exactly what Iban Wallet offers to its users.