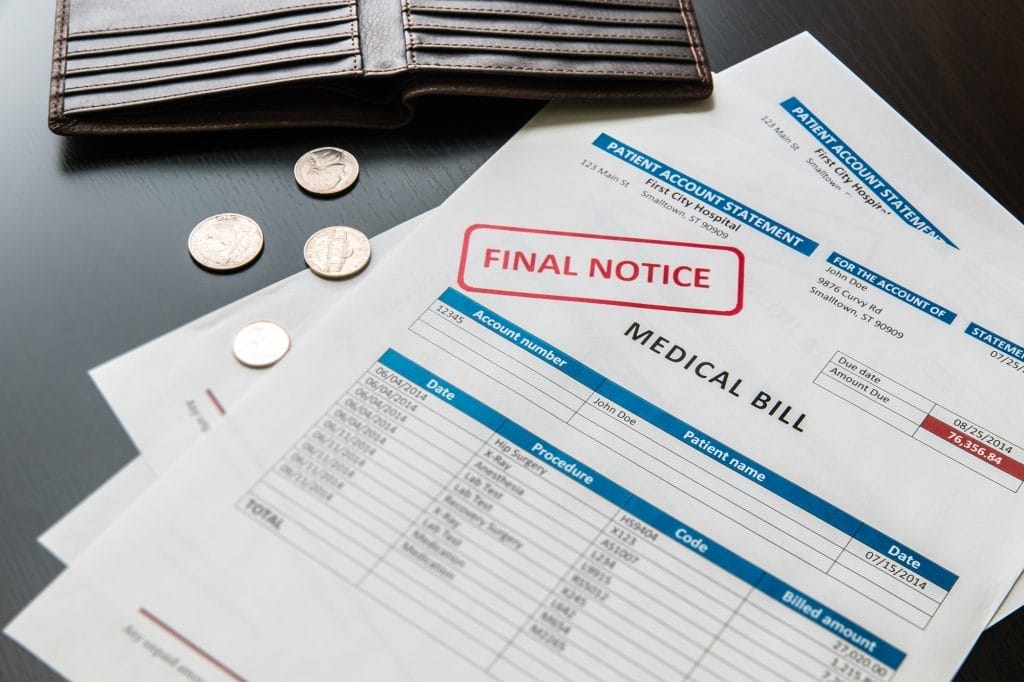

Medical bill from the hospital, concept of rising medical cost, selective focus. All data on the bill and form design are fictional, created specially for this concept.

79% of Americans are struggling with medical debt and 44 million adults do not have health insurance. Without adequate health insurance, the cost of medical care increases dramatically. People are left with mountains of bills and scrambling to figure out how to pay them.

How to pay medical bills is something everyone will grapple with at some point, whether you are insured or uninsured. And when you can’t afford them, the situation seems insurmountable.

Thankfully, there are numerous ways to attack medical bills when you’re broke.

Let’s take a look at some ways you can start getting ahead on your medical bills.

1. Shop for Insurance

By far, one of the best ways to save on medical bills is to have insurance. The cost may seem high, but there are several plans available for varying price ranges. If you have a sudden medical expense, insurance can step in and cover a portion of the cost.

Without medical insurance, you’re responsible for the entire bill, and sometimes the cost is steep. Medicaid or Medicare and its accompanying supplement plans (Medisupps.com has more information about these) are also an option for those who cannot afford traditional insurance. e.

2. Take Out a Personal Loan

Personal loans are loans that are available for larger expenses, such as home repairs, debt consolidation, or education. They’re completely personalized, and they work well when you need to pay off medical debt.

A personal loan allows you to pay off your medical debt in full and then pay back the loan in installments. They’re unique in that you only borrow as much as you need, unlike a credit card which gives you a limit on spending. The amount borrowed can be anywhere from a couple thousand dollars to larger amounts like $100,000.

The interest rate is often much lower than a credit card; some of the best personal loans are in the lower double-digits or less depending on your credit score. Make sure to shop around for the best rate if you’re considering taking out a personal loan.

3. Call the Hospital and Negotiate

Hospitals are more than willing to work with those who are having trouble paying their bills. In most cases, they’re able to set up a payment plan for you. These payment plans can vary according to your bill, but you end up making a monthly payment based on what you can afford or they can set up an income-hardship plan.

Some hospitals may offer financial aid, in which they deduct a portion of your bill. They may have a list of requirements they need from you to review your eligibility to qualify.

4. Find a Medical Bill Advocate

Medical bill errors happen on your bill and they could be costing you. A medical bill advocate is skilled at going through medical bills and spotting errors. Hiring a professional medical bill advocate could help you locate problems or extra charges that are not applicable to your bill.

If you can’t afford a medical bill advocate, it’s possible to look over your bill on your own for mistakes. Always talk to the insurance company (if you’re insured), if you believe you’ve been charged incorrectly.

5. Inquire About a Prompt-Pay Discount

Medical providers like to satisfy their patient’s bills quickly or have them paid for in advance

Some hospitals or doctor’s offices give a prompt-pay discount, in which you pay cash for your bill. Prompt-pay discounts could be helpful for those without insurance. This can sometimes knock off a percentage of your bill immediately. Just be sure to comb the bill for any errors first.

6. Find Out What Other Hospitals are Charging

Calling or researching online other hospitals or offices to ask what their prices are for services could be helpful here. Comparing the costs gives you an advantage when it comes to negotiating your bill down.

This may take a bit of extra work, especially when it comes to talking to someone who can actually help you but don’t give up.

7. Medical Credit Cards

Unlike general credit cards, medical credit cards are specifically for medical purposes. Some have a 0% interest rate for a period of time but after that, you could be hit with interest. Look over your finances to determine if you can pay it off before the low-interest rate expires so you don’t compile interest.

Help for the Future

While medical bills are never expected, there are ways to prepare for them so to lessen your stress.

Start saving money today for medical expenses, especially if you’re uninsured. Having a small nest egg available to combat medical bills can take a bit of pressure off.

Shop around for the best rates on hospitals and doctor’s visits. Sometimes switching physicians is in your best interest if the cost of a doctor’s visit is too high.

If you’re on any medications, look into ways to save on your prescriptions. Always ask your doctor if there’s a generic Call around your local pharmacy to compare prices, or look online for savings.

Medical Bill No-No’s

There is help when it comes to paying off your medical debts, but there are a few things not to do when those bills fill your mailbox.

Don’t ignore them. Even if you can’t afford to negotiate, always be in contact with your hospital to inform them of your situation. Ignoring medical bills entirely can lead to a lot of damage, including having the bill end up in collections or possible bankruptcy.

Charging your medical bills to a credit card is also unadvisable. The interest rates on credit cards are sky-high (in the teens), and adding more debt onto current debt only creates a larger problem. While your hospital may thank you, your wallet and budget will not!

How to Pay Medical Bills: There is Hope

Medical bills carry more than just a load of debt, they can invoke shame and fear in people. If you’re wondering how to pay medical bills, the options are plenty. Take steps today to start reducing your medical debt and gain peace of mind.

Looking for more money-management tips? Learn about saving, investing, and how to spend well on our website.