Image Source: EveryDollar

More than 10 million people have used Dave Ramsey’s financial plan, called the 7 Baby Steps, to get out of debt. As an extension of his financial advice, Dave released a budgeting app called EveryDollar in 2015. Since then, customers have posted over 12,000 EveryDollar app reviews in the Google Play store, rating it an average of 4.4 stars. Although this budgeting software has many loyal fans, you may still be wondering if it’s right for you. In this EveryDollar app review, we’ll break down the pros and cons to help you decide.

EveryDollar App Review

EveryDollar is built around the zero-based budgeting method, which involves giving every dollar you earn a specific job. To that end, the app helps you forecast your expected income and plan your spending for the month in advance. As long as you closely follow the budget you create, you’ll never have to wonder where your money is going.

EveryDollar offers both a free and paid version, which costs $17.99 per month or $79.99 per year when paid annually. If you want to try the premium plan, luckily there’s a 14-day free trial so you can test it out at no cost. Regardless of which version you choose, the setup process is simple—we’ll walk you through it below.

How to Get Started With EveryDollar

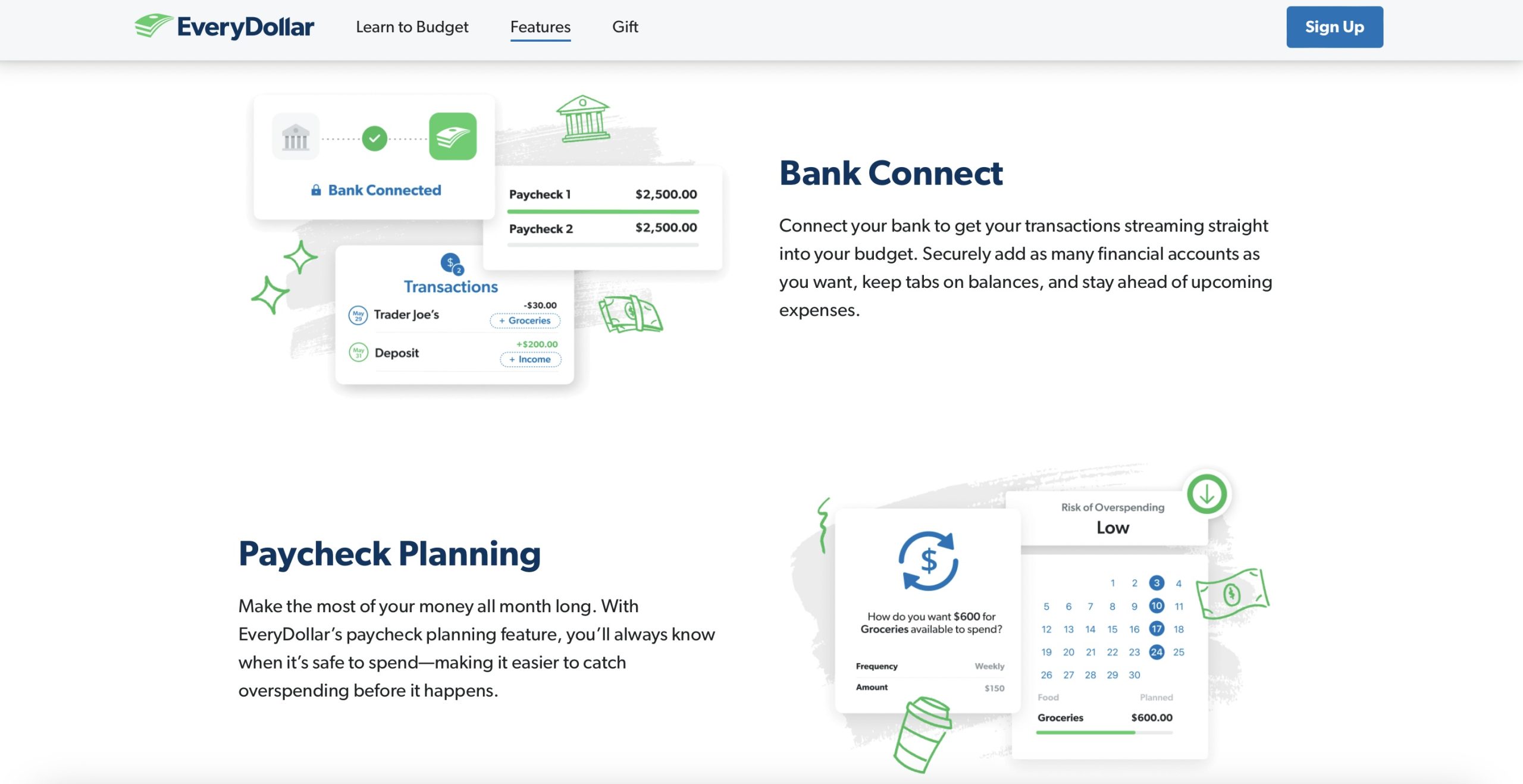

Once you download the app on your phone or computer, it will prompt you to identify the reasons you want to start saving. Whether you’re trying to pay off debt or build a travel fund, keeping your goal in mind will help motivate you to cut the fat from your budget. Next you’ll enter your income for the month in the budget tab. You can add multiple line items for your salaried income and any side hustles. Premium subscribers can link their bank account to automatically sync incoming payments and outgoing transactions.

Finally, you’ll input your typical expenses (like rent, gas, and groceries) into the template EveryDollar provides. You can customize your budget spreadsheet by adding, renaming, and moving around the categories and subcategories. Plus, you can create sinking funds for savings goals and set due dates for bills.

EveryDollar encourages users to keep assigning funds until they have nothing left to budget. This ensures your finances are optimized and every dollar is being put to good use. As you make purchases and pay bills, EveryDollar will crunch the numbers and display your remaining funds in the budget overview. Checking this figure regularly will help you avoid overspending and going into the red. If any unexpected expenses pop up, you can reassign funds as needed to cover shortfalls.

EveryDollar Pros

Image Source: EveryDollar

One of the main benefits of EveryDollar is its easy to use interface, which makes the setup process a breeze. Other zero-based budgeting apps like YNAB are known to have a steep learning curve, so we appreciate that EveryDollar is suitable for brand new budgeters. EveryDollar also offers live customer support, so you can get assistance if you need it.

Although EveryDollar makes budgeting simple, you can get granular with your budget if you want to. The app allows you to create unlimited budget categories to craft a highly detailed spending plan. Premium users can also generate multiple types of budget reports, including spending breakdowns by category, income vs. total spent, and earnings overviews.

There’s even a financial roadmap feature that allows you to forecast when you’ll meet goals like paying off debt or retiring based on your current trajectory. You can also test different scenarios and see what will happen if you allocate extra funds toward your financial targets.

Finally, we like that the app can be used on multiple devices, allowing you to budget with a partner or family member if desired.

EveryDollar Cons

Image Source: Every Dollar

There are a couple downsides to EveryDollar that you should be aware of. The free version is missing many of the useful features included in the premium plan, such as automatic bank syncing, net worth tracking, and cash flow planning. Some users feel that the free app is a bit basic, but as they say, you get what you pay for!

Premium users get extra value in the form of group coaching sessions, custom budget reports, and financial goal-setting tools. However, the premium version lacks automatic transaction categorization and only allows you to create one budget. If you need multiple budgets, you’ll have to create a separate account for each one.

The price of the premium plan is also a bit steep compared to competitors. Rocket Money, which offers extra features like credit score monitoring and bill negotiation, ranges from $6 to $12 per month. If you plan on paying monthly, going with YNAB could save you a bit of coin. Their subscription costs $14.99 per month and offers more advanced spending reports compared to EveryDollar.

EveryDollar App Reviews From Customers

Some customers complain that the app can be glitchy. One reviewer reported that EveryDollar “stops responding after 10 minutes of categorizing expenses.” However, they still gave the software 4 stars and praised the rest of the features, saying they “work great 100% of the time.”

In their EveryDollar app review, another happy customer shared that they can’t imagine living without it now. “The depth of what you can do and the ease in which this app makes it possible is life changing,” they said.

Should I Try the EveryDollar App?

Image Source: EveryDollar

Considering that the EveryDollar app is free (and you can try the premium version at no cost), there’s no reason not to download it! Whether you have the free or paid version, EveryDollar is super easy to use, which is one of its main selling points. Other zero-based budgeting apps like YNAB have a steep learning curve, but EveryDollar allows you to get up and running quickly.

We think EveryDollar is an ideal solution for new budgeters or anyone looking for a fuss-free (and potentially cost-free) way to track their expenses. Having your budget on your phone and computer puts your finances at your fingertips wherever you go. You’ll be able to make last-minute changes and stay up-to-date on how much you’re saving and spending, enabling you to gain control of your money.

On average, new EveryDollar users save $790 in their first two months, so you have nothing to lose and hundreds to gain. Download the app here and make sure to report back about your results!