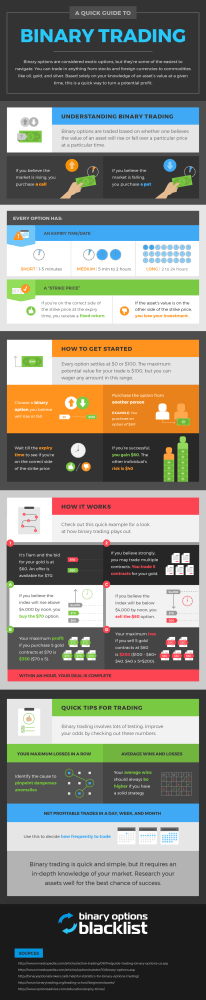

Even though binary trading is an exotic option, it’s not hard to understand once you get the basic idea down. If you have a good understanding of the value of an asset, it’s actually a quick way to make a potential profit.

Binary trading is basically answering a simple yes or no question: do you think an asset will reach a set value by a certain time? If you don’t, you can purchase a put. If you do, you can purchase a call. After the time expires, the asset will settle at $0 if it didn’t reach the set price or $100 if it did. If you were wrong, you lose your investment. However, if you were right, you earn a fixed return.

Here’s one example of binary trading: Let’s say you trade for five contracts because you have an asset you feel strongly about. The asset has an offer of $70, a bid of $60, and the question is whether it will get above $4,000 by noon. If you think it will, you can decide to buy the $70 option and your potential maximum profit is $350 ($70 x 5 = $350). On the other hand, if you don’t think it will reach $4,000, you can decide to sell. In this case, your maximum loss is $200 ($100 – $60 = $40 and $40 x 5 = $200).

Check out a more detailed explanation of binary trading below so you can decide if this trading option can help you meet your goals.