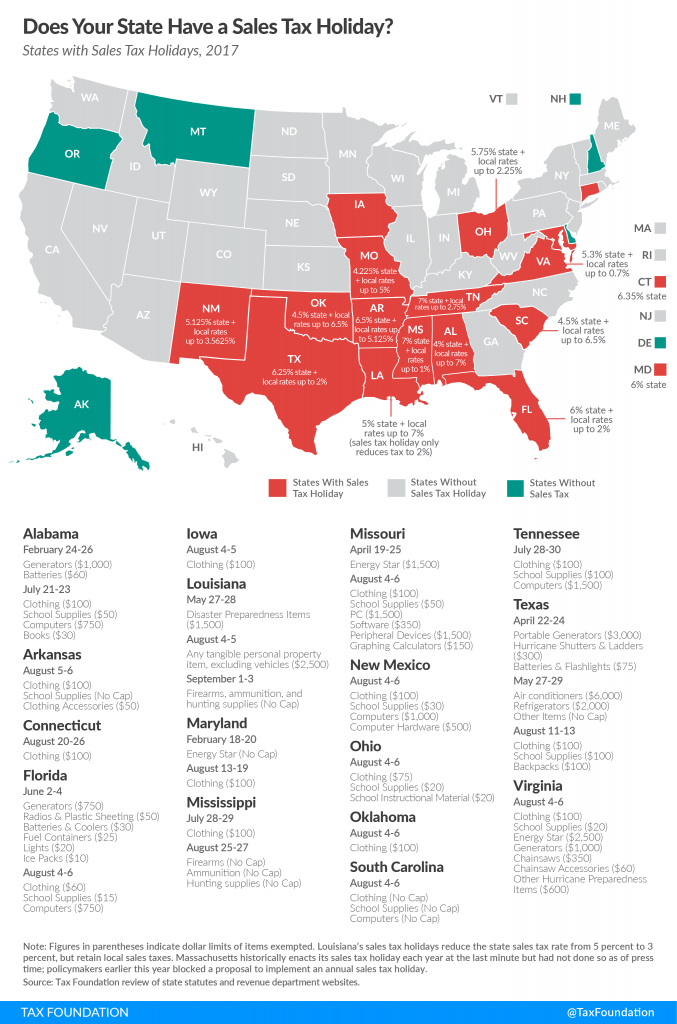

Anyone who loves to shop should consider timing their purchases to coincide with sales tax holidays; while only 16 states offer them, some shopping aficionados travel to take advantage of these tax-free windows.

It’s a good idea to find out when your state’s tax holidays occur so you can plan your shopping trips accordingly. As soon as you know when the next tax holiday near you is coming up, start looking at ads for your favorite retailers to see whether they’re offering additional promotions.

Also, try to write a shopping list ahead of time so you don’t go overboard during the sales tax holiday — otherwise you effectively wipe out any savings you would have incurred from not having to pay sales tax.

Sales Tax Holidays by State

The table below provides a rundown on the sales tax holidays offered in each of the 16 particpating states, including specific terms, types of products included, dates offered this year, and links to the respective state tax authority websites. As you can see, the 2017 holidays already occurred, but you can find out next year’s dates online if you bookmark this webpage on the U.S. Federation Tax Administrators website, which is where we obtained the chart below.

| |

Days | | | 1stYear | Dates | |

| Alabama | 3 | hurricane preparedness generators – $1,000 supplies – $60 | 2012 | February 24-26 | http://www.revenue.alabama.gov/ | |

| Alabama | 3 | clothing – $100 computers – $750 school supplies – $50 books – $30 | 2006 | July 21-23 | http://www.revenue.alabama.gov/ | |

| Arkansas | 2 | clothing – $100 school supplies | 2011 | August 5-6 | http://www.dfa.arkansas.gov/ | |

| Connecticut | 7 | clothing and footwear – $100 | 2001 | August 20-26 | http://www.ct.gov/drs/ | |

| Florida | 2 | Disaster Preparedness generators – $750 batteries – $30 fuel containers – $25 flashlights – $20 | 2017 | June 2-4 | http://floridarevenue.com/ | |

| Florida | 3 | clothing – $60 | 2007+ | August 4-6 | http://floridarevenue.com/ | |

| Iowa | 2 | clothing – $100 | 2000 | August 4-5 | https://tax.iowa.gov/ | |

| Louisiana | 2 | hurricane preparedness supplies – first $1,500 (2% rate reduction) | 2008 | May 27-28 | http://www.revenue.louisiana.gov/ | |

| Louisiana | 2 | Annual Holiday all TPP – $2,500 (2% rate reduction) | 2007 | August 4-5 | http://www.revenue.louisiana.gov/ | |

| Louisiana | 3 | firearms, ammunition and hunting supplies (2% rate reduction) | 2009 | September 1-3 | http://www.revenue.louisiana.gov/ | |

| Maryland | 3 | energy star products | 2011 | February 18-20 | http://www.comp.state.md.us/ | |

| Maryland | 7 | clothing & footwear-$100 | 2010 | August 13-19 | http://www.marylandtaxes.com/ | |

| Mississippi | 2 | clothing & footwear – $100 | 2009 | July 28-29 | http://www.dor.ms.gov/ | |

| Mississippi | 3 | firearms, ammunition and hunting supplies | 2014 | August 25-27 | http://www.dor.ms.gov/ | |

| Missouri | 7 | energy star products – $1,500 | 2009 | April 19-25 | http://dor.mo.gov/ | |

| Missouri | 3 | clothing – $100 computers – $1,500 school supplies – $50 | 2004 | August 4-6 | http://dor.mo.gov/ | |

| New Mexico | 3 | clothing – $100 computers – $1,000 computer equip. – $500 school supplies – $30 | 2005 | August 4-6 | http://www.tax.newmexico.gov | |

| Ohio | 3 | clothing – $75 school supplies – $20 | 2015 | August 4-6 | http://www.tax.ohio.gov/ | |

| Oklahoma | 3 | clothing – $100 | 2007 | August 4-6 | http://www.tax.ok.gov/ | |

| South Carolina | 3 | clothing school supplies computers other | 2000 | August 4-6 | http://www.sctax.org/ | |

| Tennessee | 3 | clothing – $100 school supplies – $100 computers – $1,500 | 2006 | July 28-30 | http://tn.gov/revenue/ | |

| Texas | 3 | generators – $3,000 | 2016 | April 22-24 | http://comptroller.texas.gov | |

| Texas | 3 | energy star products air conditioners – $6,000; other – $2,000 | 2008 | May 27-29 | http://comptroller.texas.gov/ | |

| Texas | 3 | clothing, backpacks and school supplies- $100 | 1999 | August 11-13 | http://comptroller.texas.gov/ | |

| Virginia | 3 | clothing – $100 school supplies – $20 energy star products – $2,500 hurricane preparedness items – $60 generators – $1,000 | 2006 | August 4-6 | http://www.tax.virginia.gov/ | |

(updated June 16, 2017)

+ Florida first held a sales tax holiday for school supplies in 2007. This was not re-enacted in 2008-09. Georgia first held a school supply holiday in 2004 and energy efficiency holiday in 2006. They were not re-enacted in 2010-11.

Economic Benefits

Sales tax holidays actually have benefits that go beyond your own pocketbook; the days help stimulate the economy on a local level.

Speaking of which, local economic issues can impact the status of different states’ sales tax holidays from one year to the next, so don’t assume that any state offering a tax holiday this year will do so again next year. Three states have gotten rid of their sales tax holidays since the peak participation rate of 19 states in 2010.

On the other hand, there are four states that essentially have year-round sales tax holidays on everything. Alaska, Montana, Nevada and Oregon have no sales tax at all — which is worth keeping in mind if you want to shop tax free but can’t travel on any of the dates that the sales tax hoidays are offered in the 16 states mentioned in this article.

Readers, what kind of bargains have you enjoyed from shopping during a sales tax holiday?

Source: The Tax Foundation

Jackie Cohen is an award winning financial journalist turned turned financial advisor obsessed with climate change risk, data and business. Jackie holds a B.A. Degree from Macalester College and an M.A. in English from Claremont Graduate University.