When buying a new home, many things come to mind when solidifying your new living space for the years to come — furniture, curtains, flooring, lighting, and comfort in the palpable sense. All of this does not come however, until you find the right place and meet the financial requirements to make a commitment of this magnitude. Because you’ve invested incredibly in this home, every homeowner should have a plan should anything go awry. Every homeowner needs a Plan B or a failsafe when things may go wrong. Yes, that plan would be homeowner’s insurance.

Why Do You Need Insurance?

Today many mortgage lenders won’t provide home loans without purchasing insurance from them. Depending on your policy, home insurance would kick in when something happens at your home, like the central air unit fails and causes electrical damage, or a fire, even theft occurs. Additional insurances may also be necessary depending on where you’re located (i.e tornado insurance if you live in the Midwest or flood insurance in flood risk areas). I had some friends who lived in Far Rockaway and along the Jersey Shore when Hurricane Sandy hit. Many of them didn’t have flood insurance for their home, as it was not a requirement. A devastating hit like that can be a nightmare if you haven’t made sure all of your bases are covered. Banks want to see that you will do anything possible to fulfill the commitment of your home loan. Once the banks feel you’ve provided enough collateral and coverage, you may be approved for a home loan. If approved, the next step is looking at home insurance policies.

Start Shopping For Home Insurance With Progressive HomeQuote Explorer

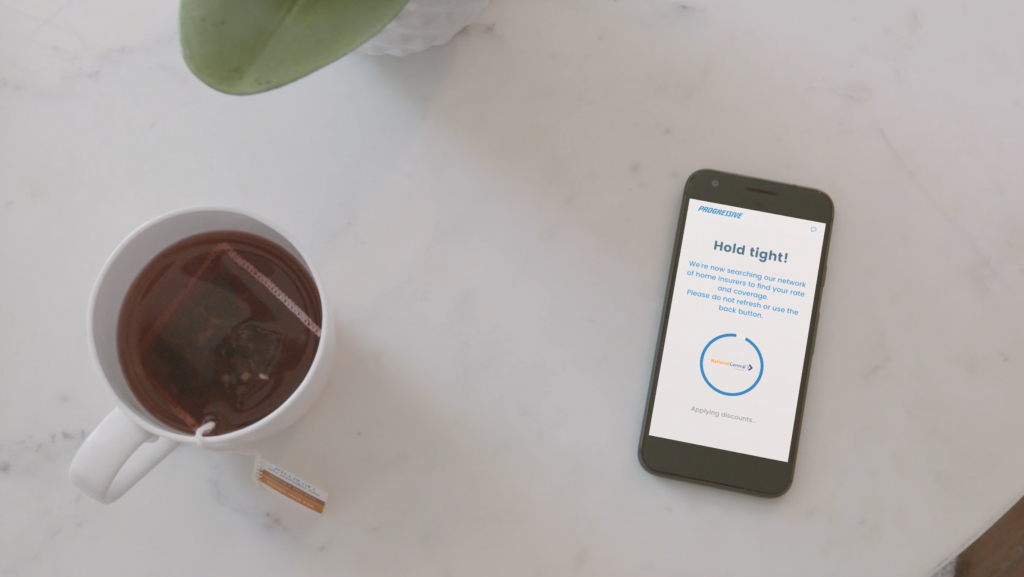

Progressive Insurance has recently released HomeQuote Explorer. It’s a nifty experience that does most of the work for you in gathering information needed for a quote. You start with just your zip code and address. The tool will actually begin a search of public records and fill in things like the year it was built, square footage, and materials it was built with. Once all of that info is gathered, you only need to fill in the blanks. HomeQuote Explorer even uses illustrations to help you determine what style of countertops you have or the kind of roofing tile was used for your home. The illustrations are provided to simplify the process. At any point in the process, you can definitely call the number provided on the site and Progressive will assist you.

Once the process is complete, HomeQuote Explorer provides rates and coverage quotes based on the information you gave during the quote process, allowing for side-by-side comparisons between multiple companies. Once your choice is made, Progressive will take care of the details with your mortgage company to easily apply the monthly cost of your premium to your mortgage (aka “escrow”), so you aren’t paying the insurance company directly, instead it’s all lumped in to your mortgage payment made to your mortgage company in one monthly payment.

Conclusion

Easy enough, right? HomeQuote Explorer aims to simplify home insurance shopping. Instead of filling in your information multiple times in order to get multiple quotes to compare price or value, or speaking with multiple agents to get your home insured, Progressive is the only insurer that lets you compare home insurance rates and coverages side-by-side on their site. HomeQuote Explorer allows you to input your information once and see quotes and rates from multiple companies all on one page. You’re able to evaluate whom you want to insure with, knowing you received a great rate in the market. In all, the process is quick and easy. With HomeQuote Explorer, you’ll have peace of mind that your home is protected for a great value with the coverage options you need. Your Plan B is lock tight whenever you may need it.

To get a quote for your home, visit HomeQuote Explorer.

Have you used the HomeQuote Explorer? What was your experience? Check out the video below to learn more!