Do you know how much you need to live on during retirement? If so, then how can you be sure you’re putting away enough each year to reach that goal? These are important questions to ask during your working years. Thankfully, free calculators like cFIREsim were created for that purpose.

Do you know how much you need to live on during retirement? If so, then how can you be sure you’re putting away enough each year to reach that goal? These are important questions to ask during your working years. Thankfully, free calculators like cFIREsim were created for that purpose.

Since my early days as a night teller in our bank’s drive up, I’ve tinkered with online calculators that measure anything from mortgages to investment portfolios to, yes, retirement. They’re such a quick tool to guide you and ensure you’re on track.

That’s why I spent time trying out a retirement calculator called cFIREsim and am sharing my findings with you.

My Honest Review: The cFIREsim Retirement Calculator

How is cFIREsim different from other retirement calculators?

CFIREsim is a free online calculator that tackles the question “Will my money last in retirement?” with an approach that differs from most of its competitors. A typical algorithm for answering this question is called the “4% rule.” Financial advisers often use this rule of thumb to assume you can withdraw 4 percent of your retirement portfolio each year if your estimated retirement spans 30 years.

Critics claim this technique doesn’t reflect recent changes in the market and may not be the most accurate tool.

That’s where cFIREsim comes in. What makes it different is its measurement of data about gold, stocks, bonds, and inflation, that dates back to 1871.

In a nutshell, once you enter your data for a 30-year retirement plan, it will show you the results of 30-year blocks of time throughout history. According to its FAQ page, “If cFIREsim says that your portfolio survived 95% of the simulation cycles, it means that if the market does no worse than the worst years in recorded stock market history, your portfolio will survive.”

Is cFIREsim user-friendly for first-timers?

MOBILE-FRIENDLY:

Yes-ish. The site does appear to be mobile-friendly, but it was difficult navigating my results page once I entered my data. The graphs and charts were too wide for my screen and made it difficult to read or scroll past them.

SITE NAVIGATION:

It took some getting used to the first time I used it. I couldn’t find a “Home” button so each time I clicked on different parts of the site (i.e. forums, FAQ, other calculators/tools), I had to click “Back.” This sent me to my original search on Google rather than cFIREsim’s home page. Delays like that made it difficult to experience the site and find answers in a timely fashion.

LAYOUT:

I love the concept of online financial calculators, but since they’re geared toward the general public, I believe it’s imperative that they’re user-friendly. Unless cFIREsim’s team created this resource for experts, they’ve got some work to do to make it easier for a general audience. Even with my years in banking and personal finance, I had great difficulty understanding A) How to fill out each of the very detailed fields and B) How to understand the results I received.

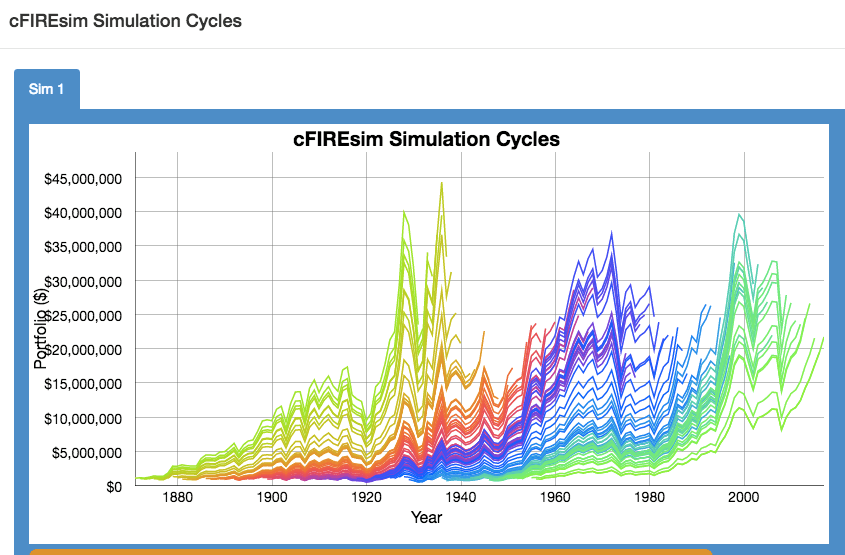

For example, after testing cFIREsim for myself and clicking “Run Simulation,” this is the first thing I saw.

It took some digging around and reading other users’ experiences with this calculator to figure out what this chart was even trying to say (and I’ll be completely honest, I still don’t know how to apply it to my financial portfolio).

I’m a huge proponent of teaching people how to understand their own investments and finances as they go because I remember how empowering that felt to me the first time. Perhaps more explanations could appear on each segment of data to help you fill out the calculator and understand your results. Much like the bubbles that pop up at various places on a website during a tutorial.

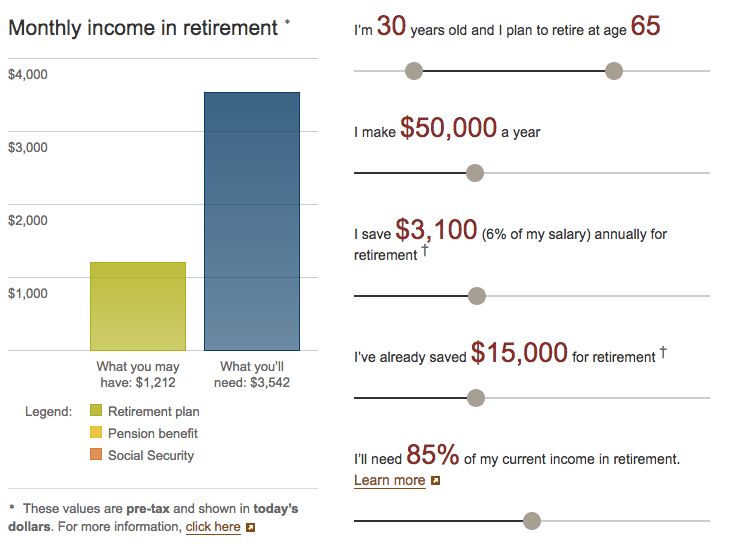

Here’s a great example of a retirement calculator designed for the general public. When you use Vanguard’s retirement calculator, it’s laid out in a much simpler configuration. The data on the right is straightforward and affects the results on the left immediately – educating you as you go. (Learn more about Vanguard’s calculator here.) See the example below:

Conclusion

The perks of using cFIREsim are:

- It’s free

- There are links to several other retirement resources

- You can access the forum to ask your questions by creating a login

- It was designed to provide you with a more accurate calculation of your retirement portfolio’s longevity

The pitfalls are:

- The data is difficult to understand with an untrained eye

- Navigation is a bit cumbersome

These are areas any committed team of developers can overcome. Perhaps we’ll see that shift happen in time. For now, I’d say give it a try (perhaps it’ll make more sense to you than to me) and if you don’t fully understand, don’t give up. Try the other calculators and resources listed under “Calculators/Other Tools.”

The ultimate goal is for you to understand how best to prepare for your own retirement. Calculators like this can be a great start, but seek the advice of a professional when you’re ready to put your retirement plan into action.

Next Read: “How to Set Yourself Up for Financial Success In Your 20s”