Are you working toward more than one financial goal? I am, too.

Are you working toward more than one financial goal? I am, too.

You’re probably aware of the fact that if you stick to one financial goal at a time that you’ll be able to keep a lot more focus and reach your goal faster. But life doesn’t always work like that.

There are many times in life when there will be several goals you want to accomplish and working toward them simultaneously will make much more sense.

A good example of this would be saving for retirement and your kids’ college education at the same time. By working on both of these you’ll take advantage of compounding interest. Another example would be saving for a vacation in conjunction with saving for a house.

There are many reasons why you would work on more than one financial goal at a time. To make this simple here’s the system I’ve created.

Create Separate Savings Accounts for Each Goal

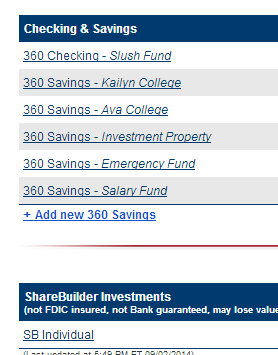

The first thing I did was set up an online savings account at Capital One 360 (formerly ING Direct.) With Capital One it’s very simple to set up several targeted savings account and you can do it all online.

Here’s a snapshot of my various savings accounts:

As you can see I have a savings account for fun money, emergency fund, my kids’ college, and an investment property. I also have a personal investing account at Capital One where I’ve been purchasing dividend stocks and an IRA at Betterment.

I love being able to log in to my accounts and view the progress of each one of my goals. If I were to lump my savings into one big account it’d be much harder to measure my progress.

Use Different Income Sources to Fund Each Goal

The next thing I do is fund each of my goals with a specific source of money.

For instance, I have $100 deducted from my checking account each month to go into my retirement account. This comes from my main income source.

Then my secondary income source (which would be blogging) gets invested. The money is either added to my investment property savings or used to purchase dividend stocks.

The rest of the accounts get added to if I have a surplus amount of money leftover at the end of the month. And since my emergency fund is already full I keep it where it is.

Reaching Your Goals is a Marathon Not a Sprint

By using the separate sources of income to fund my goals it’s easy for me to add to my savings. I’m used to being without that source of income so it’s easy to part with. My plan is to keep growing those secondary sources of semi passive income.

With that in mind I also have to remind myself that reaching any important goal takes a lot of time, commitment, and hard work. You’re not going to reach your goals overnight but if you stick with the system you will find success.

How do you save for multiple financial goals?

photo credit: jsccreationz