If you haven’t already done so, now would be a good time to check your retirement accounts to ensure they are balanced appropriately and that you are contributing as much as you can. The maximum contribution amount for 2012 is $17,000 and if you’re 50 or older, you can contribute up to $22,500 to your retirement account. I have tried to keep our contributions maxed out, and each year I have to remember to log in and make the necessary adjustments to the contribution percentage to keep up with the increasing limit from the IRS.

This year I also took a look at my 401k plan “Investment Adviser” (automated tools). I was pleased to see that they said I had all of my allocations in line with their recommendations (at least they were pretty close) and the tool also said I was on target to retire with an adequate amount of funds to meet my goals. I have a retirement target of 59 in the tool but I’d really like to stop working at least 5 years sooner than that.

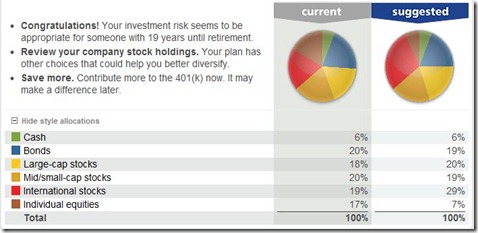

Here’s a snapshot of my allocations and their recommendations:

It looks like they think I’m a bit too heavy on individual equities but I’m pretty happy with the overall allocations at this point. I may shift a bit more of my contributions towards international equities over the next year to slowly start making a shift with new contributions but, for the most part, I’m going to leave things the way they are. I should note that, besides the individual equities, I target low cost index funds to get our market exposure. I’m not a huge fan of managed funds and tend to stay away from them. It’s also worth noting that I’m not using the “allocation by age” funds that my plan has.

6% in cash? In a retirement fund? Why?

I keep a chunk of cash in there for market dips. I don’t have any confidence that the market is going to keep going up. I think we have a number of huge risks and there will be a significant downturn in market prices. I like to keep some cash in the account to take advantage of those opportunities. Yeah, I know, people shouldn’t try to time the market but I’ve had good success with this approach.